Europe in race to secure raw materials critical for energy transition

4 min read

Critical raw materials including lithium and rare earths are likely to soon be more important than oil and gas, as Europe aims for a zero-carbon future.

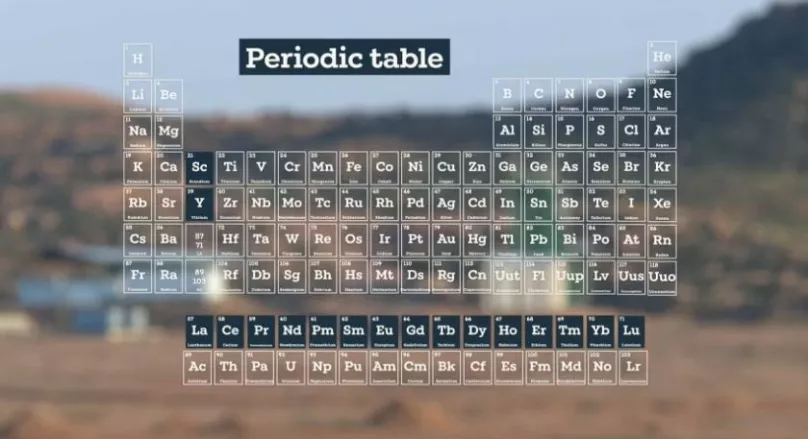

In Estonia, the small coastal town of Sillamäe in Estonia is home to the only commercial rare earth separation facility in the EU – Silmet, owned by Canadian group Neo Performance Materials. But what are rare earths and why are they integral to so many technologies?

Vasileios Tsianos, Director of Corporate Development, Neo Performance Materials explains: “Rare earths are the critical raw materials needed for the EU’s transition to green technologies.

“Case in point neodymium and praseodymium, two rare earth elements that we process at Silmet and then we will be using to make sintered rare earth permanent magnets that are energy saving and used in the drive train motors of electric vehicles, saving in some cases over 20% of the battery size needed for electric vehicles.”

Vasileios Tsianos

Director of Corporate Development, Neo Performance Materials

There are 17 rare earth elements that have hundreds of uses from missile guidance systems to banknotes, although the main use is for making ultra-powerful magnets.

Europe is well aware of the need for new mines, as well as strengthening the entire raw materials value chain.

Europe’s dependency on China and other ‘third’ countries

At the moment it is dependent on a small number of third countries, in particular China, which supplies 66% of all critical raw materials and 98% of rare earths.

The EU is due to adopt the Critical Raw Materials Act on March 14, leveraging the power of the single market, to ensure Europe has a diverse and reliable supply of these materials, while ensuring high social and environmental standards.

Vasileios Tsianos, Director of Corporate Development, Neo Performance Materials:

“Automotive OEMs (original equipment manufacturers) that make these drive train motors of electric vehicles are asking of policymakers, of government for bold policy to help with critical supply chains for electric vehicles.

“So the EU has done an incredible job with helping with the setup of battery supply chains but equivalently the lynchpin to completing this industrial policy is rare earth supply chains and if a supply chain is solely dependent on one jurisdiction, in this case China, then by single sourcing it from one jurisdiction the supply chain is at risk because of lack of diversification and if the supply chain is at risk then EU automotive jobs are at risk

“As the European Commission with its policy efforts, bold policy efforts with the Raw Materials Act and the EU Sovereignty Fund is coming online, companies like ours – Neo Performance Materials – leverages its current strategic asset of Silmet separation facility in Estonia to also make a magnet manufacturing facility in Narva.”

Vasileios Tsianos

Director of Corporate Development, Neo Performance Materials

Why is French lithium discovery important?

When it comes to lithium, as well as rare earths, Europe is dependent on other countries – notably Australia, China and South America – yet it is an essential component in the batteries of electric vehicles.

French company Imerys hopes to exploit lithium deposits found below its kaolin mine in Beauvoir, central France. Alan Parte, Lithium Projects Vice President, Imerys, explains why this matters:

“With lithium requirements in Europe set to increase tenfold by 2030, more and more projects must be developed locally to reduce this dependence. It is therefore essential to source, find and develop lithium extraction projects in France and in Europe.

“The objective of the Beauvoir project is to supply 34,000 tons of lithium hydroxide per year, which is equivalent to the need for about 700,000 electric vehicles per year.”

Alan Parte

Lithium Projects Vice President, Imerys

Another key component of the Critical Raw Materials Act is investing in and supporting innovative recycling. Of course, the more raw materials that can be recycled, the fewer need to be mined.

Neo Performance Materials plans to join up part of the rare earth supply chain with the construction of Europe’s first magnet manufacturing facility and R&D centre in the Estonian city of Narva, right next to the Russian border. It will use the separated magnetic rare earth oxides produced in Sillamäe.

Journalist • Andrea Bolitho

Video editor • Julien Bonetti